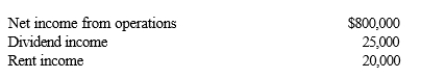

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year, Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows.  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Operating Activities

Activities related to the core business functions of a company, including production, sales, and the delivery of services.

Cash Payments

Outflows of cash by a business or individual, often documented in financial transactions for goods, services, or debts.

Insurers

Companies that provide insurance, which is a contract (policy) in which an individual or entity receives financial protection or reimbursement against losses.

Investing Activities

These activities generate cash inflows and outflows related to acquiring or disposing of noncurrent assets such as property, plant, and equipment, long-term investments, and loans to another entity.

Q44: The standard form of a journal entry

Q46: Melinda's basis for her partnership interest is

Q49: A U.S.taxpayer may take a current FTC

Q52: Sale of corporate stock by the C

Q53: BRW Partnership reported gross income from operations

Q65: List some techniques for reducing and/or avoiding

Q74: Tax-exempt income at the S corporation level

Q117: Which of the following reduces a shareholder's

Q158: Preparing tax returns and engaging in tax

Q168: Black Keys Company began the year with