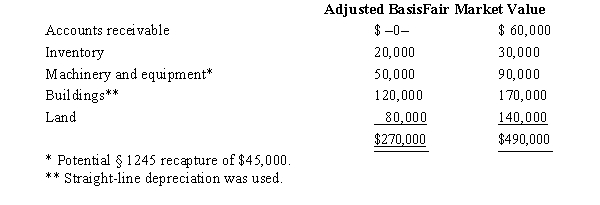

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Anticipation

The act of expecting or foreseeing something, often relating to economic expectations about future market trends or government policies.

Expected Inflation Rate

The rate at which consumers, businesses, and investors anticipate prices will rise in the foreseeable future, influencing economic behavior.

Nominal Interest Rate

The interest rate before adjustments for inflation, reflecting the rate of return as stated by the financial institution.

Real Interest Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing or real yield on an investment.

Q3: TransAm Mail Service purchased equipment for $2,500.

Q7: State income tax expense.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q18: Which, if any, of the following can

Q30: <sup></sup> 153. Sebadoah is a barber

Q38: An S shareholder's stock basis is reduced

Q61: Income from some long-term contracts can be

Q97: Nirvana Corporation issued a one-year, 9%, $400,000

Q133: The origins of accounting are attributed to

Q138: At March 1, Psychocandy Inc. reported a

Q143: Politicians frequently use tax credits and exemptions