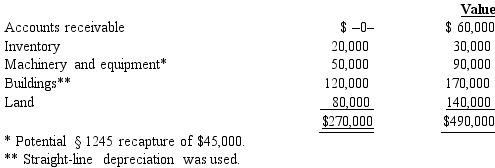

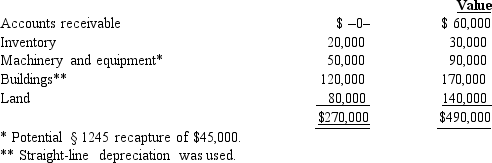

Mr.and Ms.Nguyen's partnership owns the following assets. Adjusted Basis Fair Market

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Discriminating

The cognitive ability to perceive and distinguish between differences in stimuli or information, often used in the context of recognizing or categorizing distinct elements.

Stable Marriage

A concept in algorithm theory ensuring that a set of pairings is stable if there are no two individuals who would prefer each other over their current partners.

Teens

The period of life characterized by ages 13 to 19, during which a person transitions from childhood to adulthood.

20's Or 30's

Refers to the age groups ranging from 20 to 29 years old and 30 to 39 years old, respectively, often considered significant periods in adult development.

Q16: Form 1120S provides an S shareholder's computation

Q29: All of the following are services offered

Q31: State Q wants to increase its income

Q41: The trial balance will not balance when

Q50: The termination of an S election occurs

Q92: Under what circumstances, if any, do the

Q98: Steve's basis in his SAW Partnership interest

Q106: A balance sheet shows<br>A) revenues, liabilities, and

Q108: The fair value principle is applied for<br>A)

Q160: A company shows a balance in