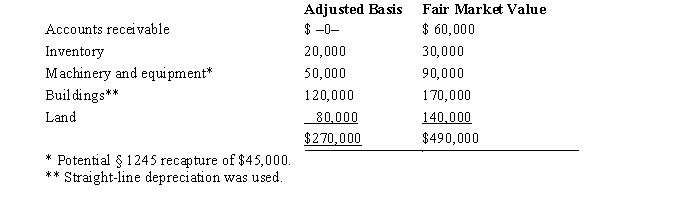

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Sexually Explicit Material

Content that openly and directly expresses or deals with sexual acts, themes, or elements.

Printing Techniques

Various methods used to transfer text and images onto paper or other materials, including digital, offset, screen, and relief printing.

Femme Porn

Femme porn refers to a genre of pornography that focuses on the desires and perspectives of women, often emphasizing emotional connection and mutual pleasure.

Erotic Fantasies

Imaginative thoughts or daydreams centered on sexual desires and activities.

Q28: If the transaction causes an asset account

Q64: The chart of accounts is a<br>A) list

Q69: The purchase of store equipment for cash

Q72: U.S.income tax treaties:<br>A)Involve three to seven countries

Q87: A shareholder's basis in the stock of

Q92: Under what circumstances, if any, do the

Q108: In the current tax year, for regular

Q110: Without the foreign tax credit, double taxation

Q110: An adjusted trial balance<br>A) is prepared after

Q155: The primary accounting standard-setting body in the