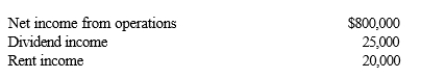

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year, Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows.  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Placenta

A structure that forms within the uterus throughout pregnancy, supplying oxygen and nutrients to the developing fetus while eliminating waste substances from the fetus's bloodstream.

Germinal Stage

The initial two weeks of prenatal development after conception, characterized by rapid cell division and the beginning of cell differentiation.

Embryonic Stage

A period of prenatal development from the second to the eighth week after conception, where major body structures and organs begin to form.

Fetal Stage

The fetal stage refers to a period in human development that begins during the 9th week of pregnancy and continues until birth, characterizing rapid growth and development of the fetus.

Q30: Which of the following statements concerning capital

Q44: Which of the following techniques are not

Q64: SurferRosa Music Store borrowed $30,000 from the

Q67: An S shareholder's basis is increased by

Q71: Unused foreign tax credits are carried back

Q78: Depreciation recapture income is a separately, nonseparately)

Q81: In 2018, Glenn recorded a $108,000 loss

Q82: The study of accounting will be useful

Q107: All of the following are characteristics of

Q126: In determining state taxable income, all of