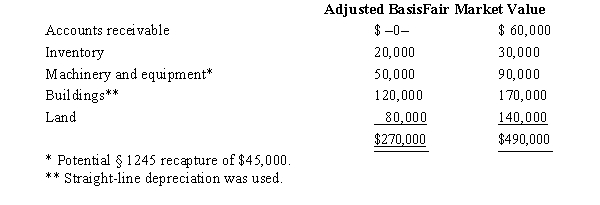

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Developmental Task

A skill or growth responsibility that arises at or during a particular life stage, which an individual needs to successfully address to achieve healthy development.

Ethnic

Relating to a population subgroup (within a larger or dominant national or cultural group) with a common national or cultural tradition.

DNA Analysis

A technique used to identify, study, and evaluate the genetic information encoded in DNA to understand genetic relationships, disorders, or ancestries.

Political

Pertaining to the governance, policies, and affairs of a state or organization, often involving power and resource distribution.

Q16: Morgan and Kristen formed an equal partnership

Q23: Julie and Kate form an equal partnership

Q28: What is the relationship between taxable income

Q31: Sale of an ownership interest by a

Q41: Which item does not appear on Schedule

Q47: With respect to special allocations, is the

Q73: The "inside basis" is defined as a

Q77: The double-entry system requires that each transaction

Q84: A balance sheet reports the assets and

Q97: The work opportunity tax credit is available