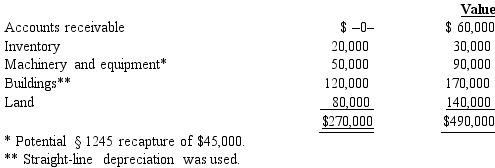

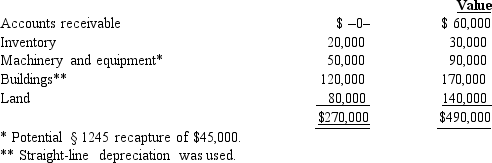

Mr.and Ms.Nguyen's partnership owns the following assets. Adjusted Basis Fair Market

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Legal Authority

An entity or person with the power granted by law or legal statute to enforce laws, exact obedience, command, determine, or judge.

Administrative Head

The top executive or leader within an administrative structure, responsible for overseeing operations and implementing policies.

Executive Agency

A type of governmental agency that is under the direct authority of the executive branch of government, often responsible for implementing certain legislation.

Discharged For Cause

Refers to the termination of employment due to an employee's failure to meet specific job standards or misconduct.

Q9: The accounting process involves all of the

Q11: Persons who were S shareholders during any

Q12: A journal provides<br>A) the balances for each

Q35: A new account is opened for each

Q52: Sale of corporate stock by the C

Q60: <sup> </sup>182. Buffalo Tom Cruises purchased

Q66: The U.S.system for taxing income earned inside

Q103: Dividend income from P & G stock

Q116: Which item is not included in an

Q180: An expense is recorded under the cash