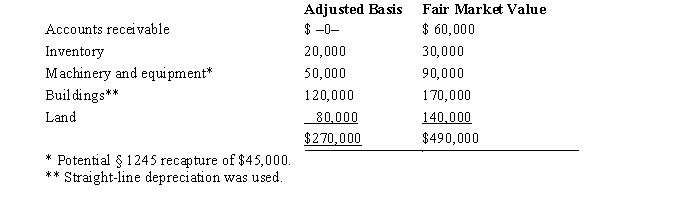

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Cell Assemblies

Conceptual groups of neurons that represent specific information through their firing patterns.

Brain-Imaging Studies

Research utilizing techniques such as MRI, PET, or CT scans to visualize the structure and function of the brain in health and disease.

Parietal Cortex

A region of the brain's parietal lobe involved in processing sensory information related to touch, spatial orientation, and navigation.

Prefrontal Cortex

The front part of the frontal lobe of the brain, associated with complex cognitive behavior, personality expression, decision making, and moderating social behavior.

Q20: Alice contributes equipment fair market value of

Q26: Without the foreign tax credit, double taxation

Q31: Some and taxation rules apply to an

Q44: The standard form of a journal entry

Q53: An account will have a credit balance

Q56: If a C corporation has earnings and

Q74: Tax-exempt income at the S corporation level

Q81: In 2018, Glenn recorded a $108,000 loss

Q91: The profits of a business owned by

Q131: International standards are referred to as<br>A) IFRS.<br>B)