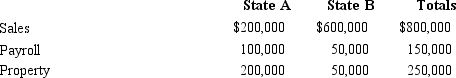

Boot Corporation is subject to income tax in States A and B.Boot's operations generated $200,000 of apportionable income, and its sales and payroll activity and average property owned in each of the states is as follows.  How much more less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three- factor apportionment formula, A uses a formula with a double-weighted sales factor?

How much more less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three- factor apportionment formula, A uses a formula with a double-weighted sales factor?

Definitions:

Error

The difference between the observed value and the true value of a parameter in data, indicative of the degree of inaccuracy or deviation.

P-value

In hypothesis testing, the p-value is the probability of obtaining test results at least as extreme as the observed results, under the assumption that the null hypothesis is correct.

Populations

The entire group of individuals or items of interest in a statistical study.

Critical Value

A point on the scale of a statistical distribution that corresponds to a specified level of significance for hypothesis testing.

Q4: Under the UDITPA's concept, sales are assumed

Q8: Prior to the effect of the tax

Q22: DIP LLC reports ordinary income before guaranteed

Q29: All of the following are services offered

Q63: In the retained earnings statement, revenues are

Q64: Most limited liability partnerships can own stock

Q117: Liabilities of a company would not include<br>A)

Q124: Treasury Bond interest income.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q139: A problem with the monetary unit assumption

Q178: The primary accounting standard-setting body in the