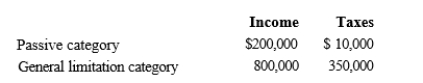

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.  Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Advertising

Advertising is a marketing communication that employs an openly sponsored, non-personal message to promote or sell a product, service or idea.

Firm's Profits

The financial gains realized by a company after subtracting all expenses, taxes, and costs from total revenue.

Efficiency

The ability to accomplish a task with the minimum expenditure of time and resources.

Q39: Walter wants to sell his wholly-owned C

Q46: If a state follows Federal income tax

Q54: The Net Investment Income Tax NIIT) is

Q66: Maria and Christopher each own 50% of

Q67: When the taxpayer operates in one or

Q71: Unused foreign tax credits are carried back

Q85: A basic assumption of accounting that requires

Q100: Keosha acquires used 10-year personal property to

Q145: General Corporation is taxable in a number

Q169: The balance sheet is frequently referred to