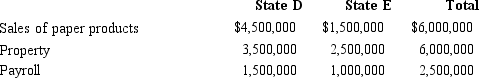

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D, and the other is located in State E.Milt generated $1,200,000 of taxable income, comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E.E does not distinguish between business and nonbusiness property.D apportions business income.Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Definitions:

Birth-Order Effect

The theoretical impact that a person's rank by age among siblings has on their personality, intelligence, and behavior.

Sexual Orientation

A persistent attraction pattern that is emotional, romantic, or sexual towards men, women, both, neither, or a different gender.

Natural Selection

A process in evolutionary biology where organisms with traits better suited to their environment are more likely to survive and reproduce, thus passing those traits on to future generations.

Erotic Plasticity

The degree to which an individual's sex drive, sexual preferences, and sexual identity can change throughout their lifetime.

Q8: If a stock dividend is taxable, the

Q9: In a limited liability company, all members

Q33: Foreign tax credit vs.deduction<br>A)Adjusted basis of each

Q37: C corporations<br>A)Usually subject to single taxation even

Q43: Which item has no effect on an

Q44: For individual taxpayers, the AMT credit is

Q51: Provide a brief outline on computing current

Q60: Constructive dividends do not need to satisfy

Q77: A long-term note is treated as "boot."

Q85: Which of the following statements is correct