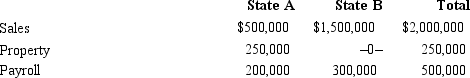

Dott Corporation generated $300,000 of state taxable income from selling its mapping software in States A and B.For the taxable year, the corporation's activities within the two states were as follows.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula which equally weights sales, property, and payroll.The rates of corporate income tax imposed in A and B are 7% and 10%, respectively.Determine Dott's state income tax liability.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula which equally weights sales, property, and payroll.The rates of corporate income tax imposed in A and B are 7% and 10%, respectively.Determine Dott's state income tax liability.

Definitions:

Large Part

A phrase indicating a significant portion or majority of a whole.

Elastic Demand

A situation where the quantity demanded of a product changes significantly in response to a change in price.

Substitutes

Products or services that can be used in place of each other; an increase in the price of one leads to an increase in demand for the other.

Available

Referring to resources or goods that are obtainable and can be utilized.

Q6: The private sector organization involved in developing

Q30: Schedule K-1<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q37: During the current year, Hawk Corporation sold

Q54: The Net Investment Income Tax NIIT) is

Q62: Why is there no AMT adjustment for

Q62: The model law relating to the assignment

Q63: Tuan and Ella are going to establish

Q65: List some techniques for reducing and/or avoiding

Q123: In the current year, Red Corporation a

Q125: AGI is used as the base for