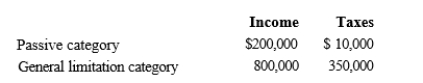

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.  Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Opening Battle

The first engagement or conflict in a war or series of battles, setting the tone and often influencing the course of the subsequent conflict.

Second Continental Congress

A convention of delegates from the Thirteen Colonies which started meeting in the spring of 1775, soon after warfare in the American Revolutionary War had begun.

Continental Army

The revolutionary war army authorized by the Continental Congress in 1775 to fight against British rule, commanded by General George Washington.

Q11: Jane and Walt form Yellow Corporation.Jane transfers

Q24: The amount of a partnership's income and

Q29: All of the following are services offered

Q35: An S shareholder who dies during the

Q52: No E & P adjustment is required

Q75: S corporations can generate an AMT adjustment

Q77: In computing the property factor, property owned

Q98: The purpose of the tax credit for

Q124: Treasury Bond interest income.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q179: If total liabilities increased by $8,000, then<br>A)