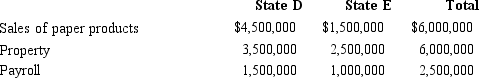

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D, and the other is located in State E.Milt generated $1,200,000 of taxable income, comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E.E does not distinguish between business and nonbusiness property.D apportions business income.Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Definitions:

Task Force

A temporary group of people formed to accomplish a specific goal, often used to address complex or urgent issues within organizations.

Ethical Behaviors

Actions that are consistent with principles of moral and ethical standards; behaving in a manner that is considered morally right.

Principled Dissenters

Individuals who oppose or challenge organizational decisions or policies on ethical or moral grounds.

Positive Role Model

An individual whose behavior, example, or success can be emulated by others, especially by younger people or peers, encouraging positive behavior and attitudes.

Q4: In the current year, the POD Partnership

Q25: S corporations<br>A)Usually subject to single taxation even

Q58: Which, if any, of the following items

Q66: Fred is the sole shareholder of an

Q77: List some techniques which can be used

Q84: For regular income tax purposes, Yolanda, who

Q86: If total liabilities increased by $30,000 and

Q108: In the current tax year, for regular

Q114: Which of the following is a principle

Q124: Tangelo Corporation has an August 31 year-end.Tangelo