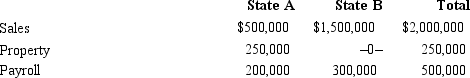

Dott Corporation generated $300,000 of state taxable income from selling its mapping software in States A and B.For the taxable year, the corporation's activities within the two states were as follows.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula which equally weights sales, property, and payroll.The rates of corporate income tax imposed in A and B are 7% and 10%, respectively.Determine Dott's state income tax liability.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula which equally weights sales, property, and payroll.The rates of corporate income tax imposed in A and B are 7% and 10%, respectively.Determine Dott's state income tax liability.

Definitions:

Mission Statement

A formal summary of the aims and values of a company, organization, or individual.

Profit Margin

A measure of profitability that indicates the percentage of revenue that exceeds the costs of goods sold.

Statement of Intentions

A document that outlines the intentions or objectives of an individual or entity, often related to future plans or actions.

Strategic Planning

The process of defining an organization's strategy or direction and making decisions on allocating its resources to pursue this strategy.

Q13: Roger owns 40% of the stock of

Q13: On January 1, 2015, Cat Power Company

Q24: Under P.L.86-272, the taxpayer is exempt from

Q36: Andrea, will not itemize deductions in calculating

Q50: The termination of an S election occurs

Q83: Which, if any, of the following items

Q90: When loss assets are distributed by an

Q98: Orange Corporation, a calendar year C corporation,

Q112: If expenses are paid in cash, then<br>A)

Q117: Seven years ago, Eleanor transferred property she