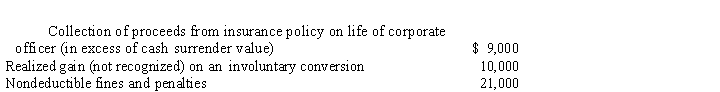

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Definitions:

Abnormal Behavior

Actions, thoughts, or emotions that deviate significantly from the norm within a culture or society, potentially interfering with personal function.

DSM-IV

The Diagnostic and Statistical Manual of Mental Disorders, Fourth Edition, a guideline published by the American Psychiatric Association that classifies and defines mental disorders.

Clinical Disorders

Clinical disorders refer to patterns of behavioral, psychological, or biological dysfunctions that are associated with distress or impaired functioning.

DSM-IV

The fourth edition of the Diagnostic and Statistical Manual of Mental Disorders, a standardized classification manual used by mental health professionals to diagnose mental disorders.

Q1: The property factor includes business assets that

Q22: In determining whether § 357c) applies, assess

Q27: Employees who render an adequate accounting to

Q27: Briefly define the term "earnings and profits."

Q43: Under the Federal income tax formula for

Q57: A taxpayer who itemizes must use Form

Q75: Because they appear on page 1 of

Q77: A shareholder's basis in property acquired in

Q87: Canary Corporation, a calendar year C corporation,

Q110: A cash basis calendar year C corporation