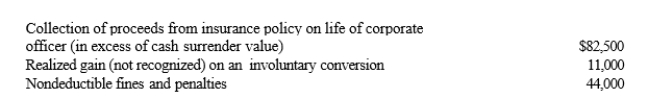

Silver Corporation, a calendar year taxpayer, has taxable income of $550,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

Definitions:

Carbon Dioxide

This odorless, color-free gas is produced during the combustion of organic compounds and carbon, as well as through respiration, and it's consumed by plants in their photosynthesis process.

Chorion

The outermost membrane surrounding an embryo in mammals, birds, and reptiles, contributing to the formation of the placenta in mammals.

Allantois

An extraembryonic membrane of reptiles, birds, and mammals that stores the embryo’s nitrogenous wastes; most of the allantois is detached at hatching or birth.

Nitrogenous Wastes

Metabolic waste compounds that contain nitrogen, commonly produced by the breakdown of proteins and nucleic acids in organisms.

Q2: Which statement is incorrect?<br>A)S corporations are treated

Q6: Which of the following income items does

Q15: Georgia contributed $2,000 to a qualifying Health

Q26: A taxpayer who uses the automatic mileage

Q30: Schedule K-1<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q34: A company has a medical reimbursement plan

Q36: Premiums paid on key employee life insurance

Q69: Rachel is single and has a college

Q98: A taxpayer who maintains an office in

Q114: Misty and John formed the MJ Partnership.Misty