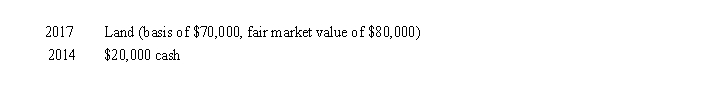

Cedar Corporation is a calendar year taxpayer formed in 2014.Cedar's E & P before distributions for each of the past 5 years is listed below.  Cedar Corporation made the following distributions in the previous 5 years.

Cedar Corporation made the following distributions in the previous 5 years.  Cedar's accumulated E & P as of January 1, 2019 is:

Cedar's accumulated E & P as of January 1, 2019 is:

Definitions:

Stockholders' Equity

The remaining interest in a company's assets after its liabilities are subtracted, signifying ownership stake.

Liabilities

Financial obligations or debts owed by a company to creditors, which must be settled over time through the transfer of assets, provision of services, or other economic benefits.

Assets

Resources owned or controlled by a business that are expected to produce economic value or benefits in the future.

Accounting Equation

A fundamental principle representing the relationship between an entity's assets, liabilities, and equity; Assets = Liabilities + Equity.

Q2: The exclusion of interest on educational savings

Q5: On a partnership's Form 1065, which of

Q18: The partnership reports each partner's share of

Q37: Capital assets donated to a public charity

Q39: Workers' compensation benefits are included in gross

Q49: Three individuals form Skylark Corporation with the

Q67: When separate income tax returns are filed

Q92: Wellington, Inc., a U.S.corporation, owns 30% of

Q110: A cash basis calendar year C corporation

Q121: Albert transfers land basis of $140,000 and