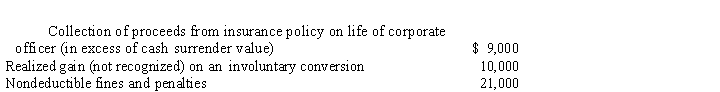

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Definitions:

GMAC Purchase Finance

Financial services related to buying, typically provided by General Motors Acceptance Corporation, focusing on auto loans and leases.

Cash Purchase Price

The amount of money required to buy a good, service, or asset without financing or credit.

Effective Interest Rate

The actual return on an investment or the real cost of borrowing, accounting for the effect of compounding interest.

Compounded Monthly

The calculation of interest on the principal amount where the interest accrued is added to the principal every month, allowing for the accumulation of interest on interest.

Q8: An S corporation does not recognize a

Q9: Matt, a calendar year taxpayer, pays $11,000

Q16: A distribution from a corporation will be

Q30: An assembly worker earns a $50,000 salary

Q83: When depreciable property is transferred to a

Q93: Publicly-traded partnership<br>A)Organizational choice of many large accounting

Q100: In international corporate income taxation, what are

Q100: Elk, a C corporation, has $370,000 operating

Q109: An S shareholder's stock basis does not

Q134: OutCo, a controlled foreign corporation in Meena