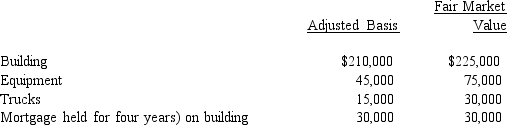

Rick transferred the following assets and liabilities to Warbler Corporation.  In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

Definitions:

Foreign Company

A business entity that is based in one country but operates and has a presence in other countries outside of its home country.

Foreign Direct Investment

An investment made by a company or individual in one country in business interests in another country, in the form of establishing business operations or acquiring business assets.

Internationalization Process

The process through which a company expands its operations beyond its national borders into the international market.

Joint Venture

A business arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task, project, or any other business activity, sharing the risks and rewards.

Q25: Section 1239 relating to the sale of

Q41: Mitchell and Powell form Green Corporation.Mitchell transfers

Q51: In 2018, an individual taxpayer has $863,000

Q55: A calendar year C corporation can receive

Q77: A long-term note is treated as "boot."

Q81: Rebecca is a limited partner in the

Q92: TEC Partners was formed during the current

Q95: Only 51% of the shareholders must consent

Q97: A deficit in current E & P

Q120: At the beginning of the tax year,