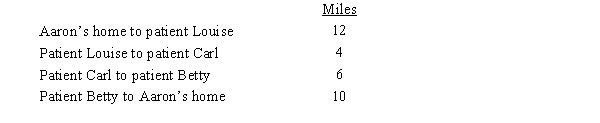

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Delegation of Authority

The process of distributing and entrusting work or decision-making power from a higher authority to lower levels within an organization or system.

Q11: The § 222 deduction for tuition and

Q15: The total tax burden on entity income

Q56: Business interest<br>A)Organizational choice of many large accounting

Q65: If a lottery prize winner transfers the

Q86: Lee, a citizen of Korea, is a

Q89: A realized gain on the sale or

Q93: If the holder of an option fails

Q100: An exchange of two items of personal

Q107: Bob lives and works in Newark, NJ.He

Q125: Carl transfers land to Cardinal Corporation for