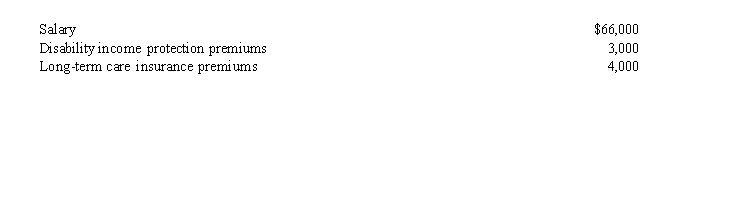

James, a cash basis taxpayer, received the following compensation and fringe benefits in the current year:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

Definitions:

Human Contact

The interaction and communication between people, which can include both physical touch and emotional connection.

Job Stress

A condition characterized by the physical and emotional reactions that occur when the requirements of a job do not match the capabilities, resources, or needs of the worker.

Poverty

The state of having insufficient financial resources to meet basic living expenses such as food, shelter, and clothing, often measured by specific economic thresholds.

Childhood Cancer

Refers to cancers that occur in children, which can have different characteristics and treatment protocols compared to cancers in adults.

Q21: Jack sold a personal residence to Steven

Q29: Sarah furnishes more than 50% of the

Q54: The exchange of unimproved real property located

Q60: If insurance proceeds are received for property

Q69: Aggregate concept<br>A)Organizational choice of many large accounting

Q77: An S corporation recognizes a on any

Q81: Gain on installment sale in 2018 deferred

Q85: Because of the taxable income limitation, no

Q87: Stanley operates a restaurant as a sole

Q124: A taxpayer who claims the standard deduction