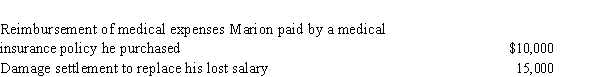

Early in the year, Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained, he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

Definitions:

Allergy

An immune system's hypersensitive reaction to normally harmless substances in the environment.

Fatigue

A state of persistent tiredness or weakness, which can be caused by physical or mental strain, lack of sleep, or health conditions.

Weakness

A reduction in the strength or power of a muscle or bodily function.

Common Cold

A viral infectious disease of the upper respiratory tract characterized by symptoms like coughing, sneezing, and a runny nose.

Q14: Kathy, who qualifies as a real estate

Q33: Alma is in the business of dairy

Q51: Sue has unreimbursed expenses.

Q53: Alan, an Owl Corporation shareholder, makes a

Q62: Organizational costs<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q79: If a taxpayer does not own a

Q98: If there is a net § 1231

Q103: Brooke works part-time as a waitress in

Q109: Which of the following statements is correct

Q117: Roger owns and actively participates in the