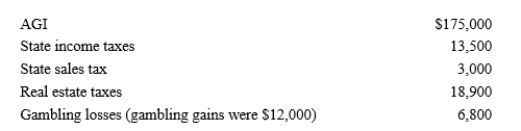

Paul, a calendar year single taxpayer, has the following information for 2018:  Paul’s allowable itemized deductions for 2018 are:

Paul’s allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Definitions:

Makeup Specialist

A professional skilled in applying cosmetic products to enhance or alter an individual's appearance.

Funeral Parlor

A business establishment where funeral services, including the preparation of the deceased for burial or cremation, are provided.

Emotional Intelligence

The ability to recognize, understand, and manage our own emotions and to recognize, understand, and influence the emotions of others.

Stress

A state of mental or emotional strain resulting from adverse or demanding circumstances.

Q8: If Wal-Mart stock increases in value during

Q23: On December 31, 2018, Flamingo, Inc., a

Q45: Which one of the following statements about

Q58: The alimony rules applicable to divorces entered

Q70: Currently, the top income tax rate in

Q78: Which of the following items, if any,

Q108: Lew owns five activities, and he elects

Q109: The purpose of the "excess business loss"

Q110: When incorporating her sole proprietorship, Samantha transfers

Q111: Donald owns a 45% interest in a