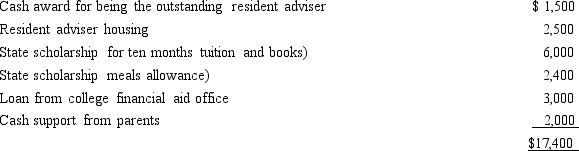

Ron, age 19, is a full-time graduate student at City University.During 2018, he received the following payments:

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2018?

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2018?

Definitions:

Dynamic Organisations

Dynamic organisations are those characterized by their ability to adapt rapidly and efficiently to changes in the external environment, technology, or market demands.

Self-Interest

The focus on one's own advantages and well-being without necessarily considering the welfare of others.

International Dimensions

Aspects or considerations related to global operations and interactions, including cultural, economic, legal, and political differences across countries.

Historical Management Theory

The study of past management practices and principles to understand the evolution of management thought and its application over time.

Q1: Dan contributed stock worth $16,000 to his

Q15: The holding period of property acquired by

Q15: Daisy Corporation is the sole shareholder of

Q34: Tern Corporation, a cash basis taxpayer, has

Q60: If a capital asset is sold at

Q69: Rachel is single and has a college

Q74: General partnership<br>A)Organizational choice of many large accounting

Q81: Ted earned $150,000 during the current year.He

Q109: Vertical, Inc., has a 2018 net §

Q112: If the alternate valuation date is elected