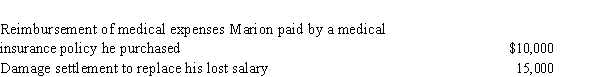

Early in the year, Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained, he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

Definitions:

Interactional Skills

The abilities required to effectively communicate and engage with others within various social contexts.

Electoral Legislation

Laws and regulations governing the conduct of elections, including the procedures for voting, campaigning, and counting ballots.

Social Policy

Policies designed to address social issues and ensure public welfare, covering areas such as health, education, and employment.

Basic Needs

Fundamental requirements necessary for individuals to live a healthy life, including food, shelter, clean water, and clothing.

Q38: Under the automatic mileage method, depreciation is

Q56: The basis for depreciation on depreciable gift

Q63: Janet works at Green Company's call center.If

Q65: If a lottery prize winner transfers the

Q67: When separate income tax returns are filed

Q67: In 1973, Fran received a birthday gift

Q82: Which of the following statements is incorrect

Q122: Ralph made the following business gifts during

Q127: Three years ago, Sharon loaned her sister

Q159: If the amount of the insurance recovery