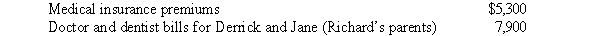

Richard, age 50, is employed as an actuary.For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

Definitions:

Lifelong Needs Establishment

The process of identifying and meeting the diverse and changing needs of individuals throughout their entire lives.

Medical Care

The services provided by professionals to diagnose, treat, and prevent illness and maintain physical and mental well-being.

Live in Poverty

The state of experiencing a lack of financial resources below a certain income threshold, affecting an individual's or family's ability to meet basic needs.

Q22: Under the income tax formula, a taxpayer

Q24: In 2014, Harold purchased a classic car

Q35: The transfer of an installment obligation in

Q53: Fran is a CPA who has a

Q67: In 1973, Fran received a birthday gift

Q67: Carla is a deputy sheriff.Her employer requires

Q74: Personal use property casualty gains and losses

Q94: Puffin Corporation makes a property distribution to

Q101: Adrienne sustained serious facial injuries in a

Q157: Last year, taxpayer had a $10,000 nonbusiness