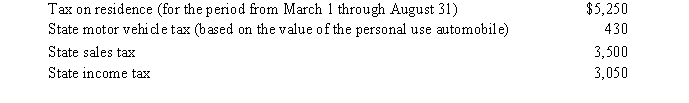

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Definitions:

Self-representation

The way in which individuals present themselves and their identities to others, often through personal expression and social media.

Marginalized Groups

Populations or communities that are excluded or discriminated against, leading to lower social, economic, or political status.

Mainstream Culture

The prevailing cultural norms, values, and practices of the dominant society.

Taqwacore Movement

A subculture that blends Islam with punk music, challenging stereotypes and addressing issues of identity among Muslim youth.

Q5: When computing current E & P, taxable

Q25: Evan and Eileen Carter are husband and

Q27: If Abby's alternative minimum taxable income exceeds

Q34: After the divorce in 2015, Jeff was

Q41: A personal use property casualty loss that

Q49: A corporation borrows money to purchase State

Q65: The amount of partial worthlessness on a

Q98: If there is a net § 1231

Q107: A net operating loss occurring in 2018

Q120: Robin Corporation distributes furniture basis of $40,000;