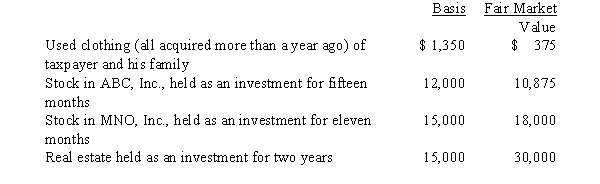

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

Definitions:

Missouri Compromise

An agreement passed in 1820 allowing Missouri to enter the Union as a slave state and Maine as a free state, establishing a precedent for the future admission of states in pairs.

Thomas Jefferson

The third President of the United States (1801-1809) known for authoring the Declaration of Independence and for his contributions to the founding principles of the United States.

Statehood

The status of being recognized as an independent nation or the admission of a territory as a state within the United States.

War of 1812

A military conflict between the United States and Great Britain from 1812 to 1815, largely resulting from issues related to trade restrictions and impressment of American sailors.

Q4: Recognized gains and losses from disposition of

Q34: The fair market value of property received

Q38: Under the automatic mileage method, depreciation is

Q71: Gift property disregarding any adjustment for gift

Q78: Bill paid $2,500 of medical expenses for

Q84: Lloyd, a practicing CPA, pays tuition to

Q101: Many taxpayers who previously itemized will start

Q104: Thrush, Inc., is a calendar year, accrual

Q110: In January 2019, Pam, a calendar year

Q128: Sarah's employer pays the hospitalization insurance premiums