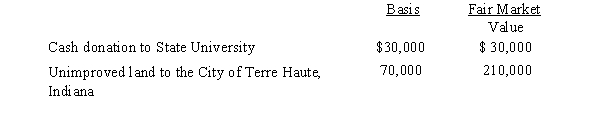

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

Definitions:

Main Components

Essential parts or elements that make up a system, structure, or principle, foundational to its function or identity.

Informational Social Influence

The process of aligning one's thoughts or behaviors with those of a group because of a desire to be correct or to understand the correct way to act in a given situation.

Normative Social Influence

The influence of other people that leads an individual to conform in order to be liked or accepted by them.

Private Acceptance

A genuine inner belief that others are right.

Q19: Which of the following decreases a taxpayer's

Q27: Hunter and Warren form Tan Corporation.Hunter transfers

Q72: Schedule M-3 is similar to Schedule M-1

Q75: Noah gave $750 to a good friend

Q82: Brad, who uses the cash method of

Q85: When current E & P is positive

Q95: In 2017, Jenny had a $12,000 net

Q100: An exchange of two items of personal

Q109: Arthur owns a tract of undeveloped land

Q121: Renee, the sole shareholder of Indigo Corporation,