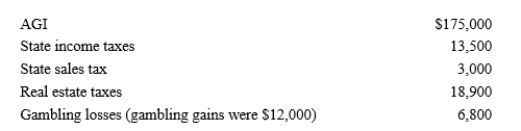

Paul, a calendar year single taxpayer, has the following information for 2018:  Paul’s allowable itemized deductions for 2018 are:

Paul’s allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Definitions:

Marginal Tax Rate

The tax rate applicable to the last dollar of an individual's or entity's taxable income.

Cost of Debt

The effective rate that a company pays on its current debt, which can include loans, bonds, and any other interest-bearing liabilities.

Market Risk Premium

The extra return expected by investors for holding a risky market portfolio instead of risk-free assets, reflecting the additional risk.

Dividend

The payment made by a corporation to an equity investor (stockholder).

Q24: A security that was purchased by an

Q33: In a § 351 transfer, a shareholder

Q34: Tern Corporation, a cash basis taxpayer, has

Q46: From January through November, Vern participated for

Q46: Rust Corporation distributes property to its sole

Q69: Dan and Donna are husband and wife

Q97: A corporation's holding period for property received

Q105: Individuals who are not professional real estate

Q131: Under the Swan Company's cafeteria plan, all

Q137: Dena owns interests in five businesses and