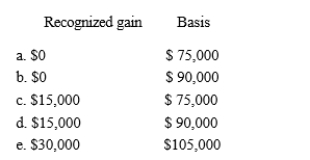

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Definitions:

Sense Of Self

An individual's perception and awareness of their own identity, personality, and existence.

Loss Of A Parent

The experience and emotional process following the death of a parent, significantly impacting an individual’s psychological state and life.

Influences

The power to have an important effect on someone or something, often leading to changes in behavior or outcomes.

Mortality Rate

A measure of the number of deaths (in general, or due to a specific cause) in a particular population, scaled to the size of that population, per unit of time.

Q52: The kiddie tax does not apply to

Q52: Travis and Andrea were divorced in 2016.Their

Q58: Oriole Corporation has active income of $45,000

Q63: Jacob and Emily were co-owners of a

Q72: Involuntary conversion gains may be deferred if

Q74: Maroon Corporation expects the employees' income tax

Q95: In 2017, Jenny had a $12,000 net

Q98: If there is a net § 1231

Q115: The carryover basis to a donee for

Q119: A baseball team that pays a star