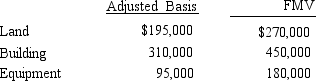

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

Definitions:

Hotel Chains

Groups of hotels operated by the same company or owner, often sharing a brand, marketing, and standardized amenities.

Innovative Projects

Initiatives that introduce new ideas, methods, or products.

Counterproductive Projects

Projects or initiatives that have the opposite of the intended effect, often causing more harm than good.

Q14: Tom, a cash basis taxpayer, purchased a

Q23: Rachel acquired a passive activity several years

Q72: Involuntary conversion gains may be deferred if

Q95: Qualified business income QBI) is defined as

Q96: Taylor, a cash basis architect, rents the

Q106: In the current year, Louise invests $50,000

Q120: In the current year, Oriole Corporation donated

Q149: Cora purchased a hotel building on May

Q160: MACRS does not use salvage value.As a

Q178: In the current year, Tern, Inc., a