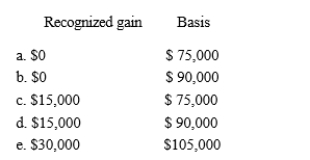

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Definitions:

Profits

The financial gain realized when the revenue from selling goods or services exceeds the costs of production.

Monopolized

Refers to a market structure where a single firm or entity controls a significant portion of the market share, reducing competition.

Consumer Surplus

Consumer Surplus is the difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually do pay.

Net Social Gain

The overall benefit to society, calculated by subtracting total social costs from total social benefits.

Q2: Under the taxpayer-use test for a §

Q15: During the year, John a self-employed management

Q35: Qualified business income includes the "reasonable compensation"

Q36: If the fair market value of the

Q50: Katelyn is divorced and maintains a household

Q67: If § 1231 asset casualty gains and

Q89: Child and dependent care expenses include amounts

Q108: Discuss the tax consequences of listed property

Q113: Joe, a cash basis taxpayer, took out

Q158: In applying the $1 million limit on