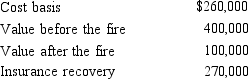

John had adjusted gross income of $60,000 in 2018.During the year his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

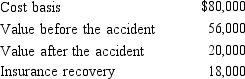

John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows: What is John's itemized casualty loss deduction?

What is John's itemized casualty loss deduction?

Definitions:

Q1: Dan contributed stock worth $16,000 to his

Q2: A GAAP financial statement includes footnotes that:<br>A)Give

Q46: Which of the following taxpayers may file

Q74: Under the terms of a divorce agreement

Q87: Capital recoveries include:<br>A)The cost of capital improvements.<br>B)Ordinary

Q94: Gary cashed in an insurance policy on

Q126: Which of the following may be deductible

Q175: Discuss the tax treatment of non-reimbursed losses

Q180: Briefly explain why interest on money borrowed

Q189: Payments by a cash basis taxpayer of