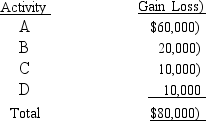

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive activity loss can Hugh deduct this year? Calculate the suspended losses by activity).

How much of the $80,000 net passive activity loss can Hugh deduct this year? Calculate the suspended losses by activity).

Definitions:

Planning Budget

A budget prepared for a specific level of activity, detailing the expected revenues and expenses to guide financial planning.

Net Operating Income

A profitability measure calculated as the difference between a company's revenues from its operations and its operating expenses, excluding non-operating expenses and income.

Administrative Expenses

Costs related to the general management and administration of an organization, such as salaries of executive officers and costs of legal services.

Net Operating Income

The profit a company makes from its usual business operations, before taxes and interest, calculated by subtracting operating expenses from revenue.

Q9: Paula is the sole shareholder of Violet,

Q12: White Company acquires a new machine for

Q14: Tom, a cash basis taxpayer, purchased a

Q17: You are assisting LipidCo, a U.S.corporation subject

Q27: If Abby's alternative minimum taxable income exceeds

Q45: On February 1, Karin purchases real estate

Q48: Our tax laws encourage taxpayers to _assets

Q73: During 2018, Madison had salary income of

Q97: To compute the holding period, start counting

Q156: Indigo Company acquires a new machine 5-year