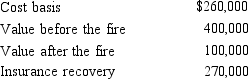

John had adjusted gross income of $60,000 in 2018.During the year his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

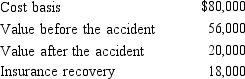

John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows: What is John's itemized casualty loss deduction?

What is John's itemized casualty loss deduction?

Definitions:

Cohesiveness

The degree to which members are attracted to and motivated to remain part of a team.

Quality Circle

A group of employees who periodically meet to discuss ways of improving work quality.

Team Building

A sequence of collaborative activities to gather and analyse data on a team and make changes to increase its effectiveness.

External Coach

A professional advisor not employed by the client's organization who provides guidance and support for personal or professional development.

Q18: Tonya is a cash basis taxpayer.In 2018,

Q22: A scholarship recipient at State University may

Q32: Nancy gives her niece a crane to

Q36: Last year, Ted invested $100,000 for a

Q42: JiangCo constructs the following table in determining

Q47: Phyllis, Inc., earns book net income before

Q55: Joyce, an architect, earns $100,000 from her

Q68: In the "rate reconciliation" of GAAP tax

Q99: Taxable income for purposes of § 179

Q116: Purchased goodwill is assigned a basis equal