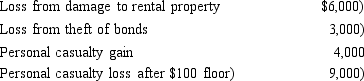

In 2018, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  The personal casualties occurred in a Federally-declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

The personal casualties occurred in a Federally-declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Physiological Equilibrium

The state of balance or stability in the body's internal environment, maintained through various biological processes.

Drive Reduction

A theory in psychology that posits that actions are motivated by the desire to reduce internal drives, such as hunger, that arise from biological needs.

Work Assignment

A task or set of tasks given to an individual or group as part of their job or studies.

Incentive

Something that motivates or encourages an individual to take action or behave in a certain way.

Q9: In 2008, Terry purchased land for $150,000.In

Q17: Juan, was considering purchasing an interest in

Q31: On June 1 of the current year,

Q32: In 2018, Grant's personal residence was completely

Q57: Kim dies owning a passive activity with

Q66: Property sold to a related party that

Q106: Which of the following is not a

Q109: Arthur owns a tract of undeveloped land

Q131: Sandra acquired a passive activity three years

Q171: Josh has investments in two passive activities.Activity