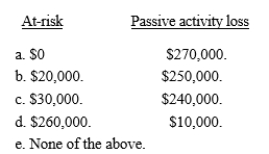

Several years ago, Joy acquired a passive activity.Until 2016, the activity was profitable.Joy's at-risk amount at the beginning of 2016 was $250,000.The activity produced losses of $100,000 in 2016, $80,000 in 2017, and $90,000 in 2018.During the same period, no passive activity income was recognized.How much is suspended under the at-risk rules and the passive activity loss rules at the beginning of 2019?

Definitions:

Entropy Principle

A tendency toward balance or equilibrium within the personality; the ideal is an equal distribution of psychic energy over all structures of the personality.

Psychic Energy

A Freudian concept referring to the energy generated by innate drives and instincts, which powers the mind and motivates behavior.

Collective Unconscious

The deepest level of the psyche containing the accumulation of inherited experiences of human and pre-human species.

Rational Functions

In psychology, this refers to cognitive processes involved in logical reasoning, decision-making, and problem-solving.

Q8: Gray Company, a closely held C corporation,

Q14: Section 1231 lookback losses may convert some

Q28: Transactions between related parties that result in

Q30: The effect of § 1244 may be

Q43: In 2017, Robin Corporation incurred the following

Q46: Which of the following taxpayers may file

Q91: Joel placed real property in service in

Q95: Nathan owns Activity A, which produces income,

Q109: The purpose of the "excess business loss"

Q114: Gloria owns and works fulltime at a