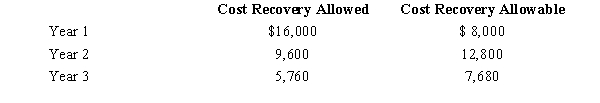

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are computed as follows.  If Tara sells the machine after three years for $15,000, how much gain should she recognize?

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

Definitions:

Supreme Court

The highest judicial body in a country, responsible for interpreting the constitution and reviewing laws to ensure they comply with the constitution.

Guilty

A legal status describing someone who has been found responsible for committing a crime or wrongdoing.

OPEC

The Organization of the Petroleum Exporting Countries, a group of oil-producing nations that coordinate petroleum policies and prices internationally.

World's Oil

Refers to the global production, distribution, and consumption of crude oil as a key energy source.

Q14: To qualify for the § 121 exclusion,

Q35: The "petitioner" refers to the party against

Q37: Jim had a car accident in 2018

Q40: Robin Corporation has ordinary income from operations

Q56: A landlord leases property upon which the

Q64: The IRS issues an acquiescence or nonacquiescence

Q79: The FICA tax Medicare component) on wages

Q103: Cason is filing as single and has

Q115: The carryover basis to a donee for

Q206: George purchases used seven-year class property at