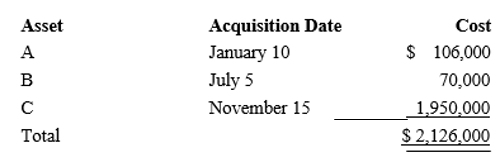

Audra acquires the following new five-year class property in 2018:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not claim any available additional first-year depreciation deduction.Determine her total cost recovery deduction including the § 179 deduction) for the year.

Definitions:

Freudian Theory

A psychological framework developed by Sigmund Freud that emphasizes unconscious motivations and conflicts as driving human behavior and personality development.

Life-giving Instinct

An innate or natural drive in living beings to reproduce or engage in behaviors that sustain life or promote well-being and survival.

Thanatos

In psychoanalytic theory, it represents the death drive, postulated by Freud as a basic human instinct oriented toward self-destruction and destructiveness.

Eros

In Freudian theory, the constructive, life-giving instinct.

Q20: To qualify as a like-kind exchange, real

Q23: A letter ruling applies only to the

Q80: The computations required for the net present

Q80: On January 2, 2018, Fran acquires a

Q95: Carlos purchased an apartment building on November

Q102: Gil's office building basis of $225,000 and

Q151: Tara owns a shoe store and a

Q162: Two years ago, Gina loaned Tom $50,000.Tom

Q165: Gary, who is an employee of Red

Q178: A taxpayer is considered to be a