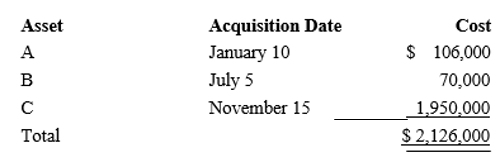

Audra acquires the following new five-year class property in 2018:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not claim any available additional first-year depreciation deduction.Determine her total cost recovery deduction including the § 179 deduction) for the year.

Definitions:

Primary Sources

Original documents, records, or evidence directly associated with a subject, used in research for first-hand or direct evidence.

Secondary Sources

Materials such as books, articles, and commentaries that analyze, critique, or summarize the law, but are not legally binding.

Legal Research

The method of locating and obtaining information essential for making legal decisions.

Plain-Meaning Rule

A principle of legal interpretation that directs courts to interpret statutes according to the ordinary meaning of the language used, absent a clear indication of an alternative intent.

Q13: Barney painted his house which saved him

Q27: A partnership owned at least 80% by

Q44: Sharon made a $60,000 interest-free loan to

Q59: The tax concept and economic concept of

Q103: An advance payment received in June 2018

Q130: When a business is being purchased, if

Q149: All of a taxpayer's tax credits relating

Q154: Purchased goodwill must be capitalized, but can

Q159: Ivory Corporation, a calendar year, accrual method

Q185: Hazel purchased a new business asset five-year