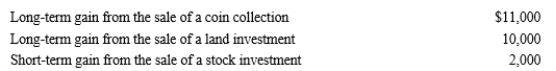

Kirby is in the 12% tax bracket and had the following capital asset transactions during 2018:

Kirby’s tax consequences from these gains are as follows:

A) 5% × $10,000) + 12% × $13,000).

B) 12% × $13,000) + 28% × $11,000).

C) 0% × $10,000) + 12% × $13,000).

D) 12% × $23,000).

E) None of these.

Definitions:

Oligopoly

A market structure characterized by a small number of firms dominating the market, leading to limited competition and potentially higher prices.

Interdependent Firms

Companies whose strategies, actions or performances are mutually influenced or dependent on each other.

Barriers to Entry

Factors that make it difficult for new firms to enter a market, such as high start-up costs or strict regulations.

Oligopoly

A market form characterized by a small number of firms controlling a large market share, often leading to limited competition.

Q10: Why are there restrictions on the recognition

Q34: State income taxes generally can be characterized

Q41: Which of the following sources has the

Q69: Logan dies with an estate worth $20

Q87: Indicate which, if any, statement is incorrect.State

Q99: On September 3, 2017, Able, a single

Q120: The manager of a profit center does

Q162: Two years ago, Gina loaned Tom $50,000.Tom

Q193: If an automobile is placed in service

Q199: Terry and Jim are both involved in