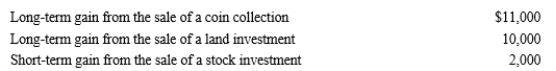

Kirby is in the 12% tax bracket and had the following capital asset transactions during 2018:

Kirby’s tax consequences from these gains are as follows:

A) 5% × $10,000) + 12% × $13,000).

B) 12% × $13,000) + 28% × $11,000).

C) 0% × $10,000) + 12% × $13,000).

D) 12% × $23,000).

E) None of these.

Definitions:

Corporate Social Responsibility

The idea that firms have obligations to society beyond their financial obligations to owners and stockholders, and also beyond those prescribed by law or contract.

Production Manager

A professional responsible for overseeing the production process, managing staff, and ensuring the efficient output of high-quality products.

Comfort Zone

A psychological state in which individuals feel familiar, safe, and at ease, often leading to a level of complacency that hinders growth and learning.

Apparel Boutique

A small, specialized retail store that offers a selection of clothing and accessories, often focusing on unique, high-quality, or fashion-forward items.

Q13: Average rate of return equals average investment

Q16: A deferred tax liability represents a current

Q23: A letter ruling applies only to the

Q26: Doug purchased a new factory building on

Q30: The release of a valuation allowance may

Q65: The management of Retz Corporation is

Q66: Gain on the sale of collectibles held

Q95: Carlos purchased an apartment building on November

Q104: Peggy is in the business of factoring

Q172: On January 15, 2018, Vern purchased the