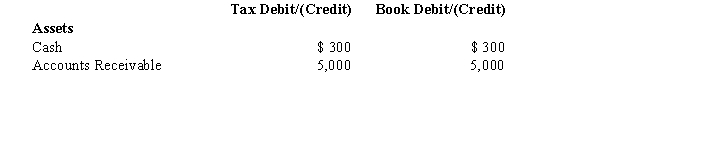

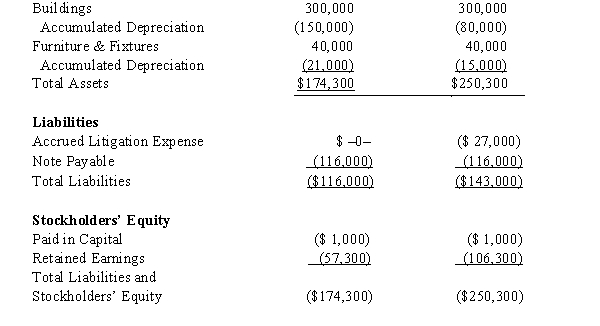

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.

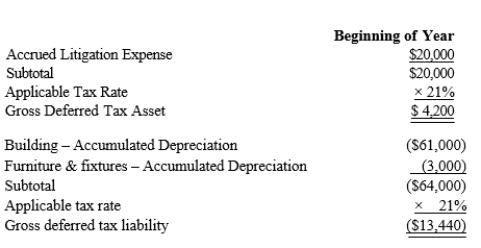

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the change in Black's deferred tax assets for the current year.

Definitions:

Specific Positions

Targeted or particular roles within an organization or structure, each with defined responsibilities and tasks.

Interpersonal Relations

The connections and interactions between individuals within an organization, affecting communication, teamwork, and morale.

Group Development Process

The stages that a group goes through from formation to termination, typically characterized as forming, storming, norming, performing, and adjourning.

Accepted Practice

A method or procedure that is widely recognized and adopted within an industry or profession as a standard or appropriate course of action.

Q3: The realization requirement gives an incentive to

Q38: A taxpayer may not appeal a case

Q47: The process by which management allocates available

Q66: Can a trade or business expense be

Q71: Compare Revenue Rulings with Revenue Procedures.

Q88: In the current year, Crow Corporation, a

Q115: Treatment of an installment sale of a

Q122: Discuss the reason for the inclusion amount

Q127: Supervisor salaries, maintenance, and indirect factory wages

Q176: Susan has the following items for 2018:<br>?