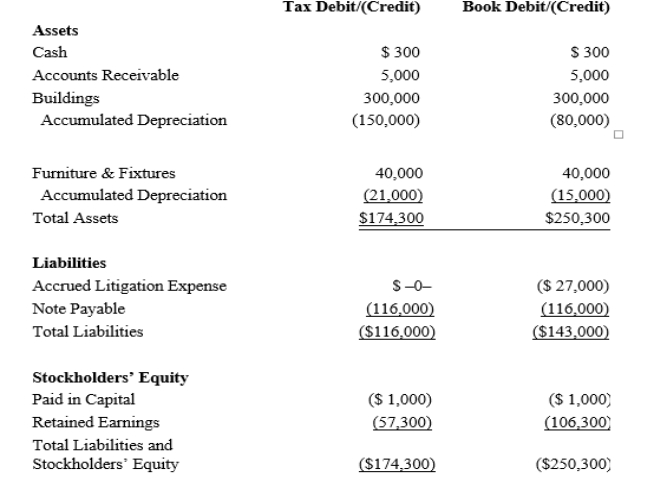

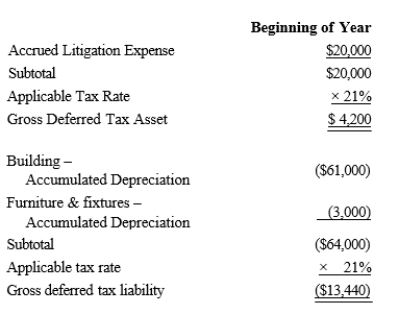

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.  Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Calculate Black's current tax expense.

Definitions:

Funnel Sequence

A structured approach to narrow down information or options, typically starting broad and becoming more specific.

Inverted Funnel Sequence

A communication strategy or storytelling method that starts with broad, general information and narrows down to specific details.

Hourglass Sequence

A narrative or structural format that starts and ends broadly, with a tighter focus or narrower scope in the middle.

Closing Phase

The final stage in a process or activity, where completion is prepared and assessed.

Q3: Maple Company purchases new equipment 7-year MACRS

Q8: On May 30, 2017, Jane purchased a

Q14: Tom, a cash basis taxpayer, purchased a

Q25: A series of unequal cash flows at

Q34: An example of a deferred tax asset

Q99: Standard costs should be revised when they

Q104: On June 1, 2018, Red Corporation purchased

Q126: Significant participation activity.<br>A)Taxpayer devotes time aggregating more

Q135: Separation of businesses into more manageable operating

Q148: On March 1, 2018, Lana leases and