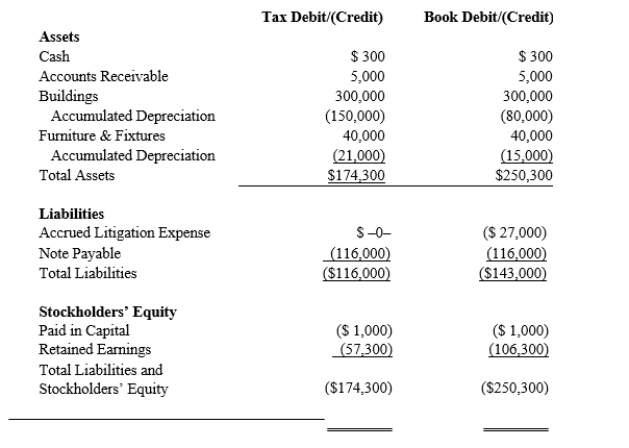

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.  Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

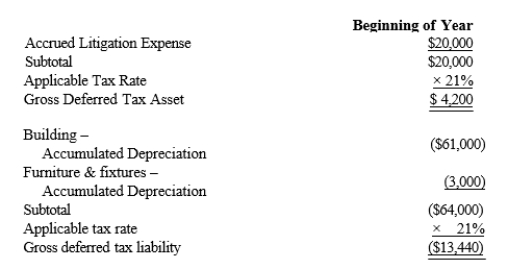

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Provide the journal entry to record Black's current tax expense.

Definitions:

Tariff

A tax levied on imported goods.

Imported Goods

Products brought into one country from another for the purpose of sale or trade.

Foreign Sales Representative

An agent who represents a company's product or services in foreign markets, often responsible for securing and managing international sales.

Foreign Seller

refers to a seller or supplier who is located in a different country than the buyer, typically involving cross-border transactions subject to international trade laws.

Q3: In 2018, Cindy is married and files

Q17: In the rate of return on investment

Q19: The investment turnover is calculated as the

Q19: Giant uses the "equity method" to account

Q45: An advance payment received in June 2018

Q55: The anticipated purchase of a fixed asset

Q86: Which of the following provisions of the

Q88: Under the negotiated price approach, the transfer

Q158: In applying the $1 million limit on

Q173: Discuss the requirements in order for startup