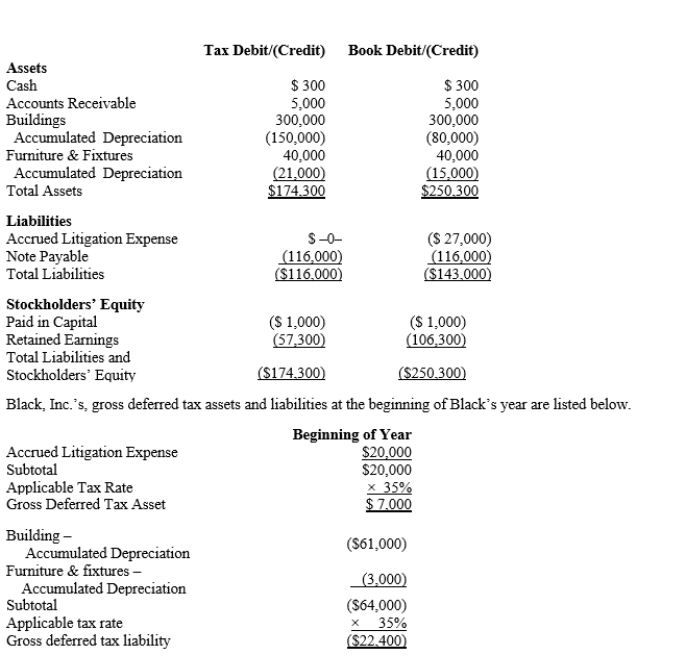

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  ?

?

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense.Determine the change in Black's deferred tax liabilities for the current year.

Definitions:

Culture

The collective manifestations of human intellectual achievement regarded collectively, often expressed through art, music, traditions, and languages.

Symbols

Marks or signs used to represent an idea, object, or relationship.

Beliefs

The convictions or acceptances that something exists or is true, especially without proof.

Attitudes

A settled way of thinking or feeling about something, typically reflected in a person's behavior.

Q11: Norm's car, which he uses 100% for

Q45: A partnership owned at least 80% by

Q47: Joe purchased a new five-year class asset

Q61: A problem with placing excessive emphasis on

Q65: Cleaners, Inc.is considering purchasing equipment costing

Q67: The cash payback period is calculated by

Q76: Which, if any, of the following transactions

Q81: Caroyl made a gift to Tim of

Q104: Placard, a multinational corporation based in the

Q169: Discuss the relationship between realized gain and