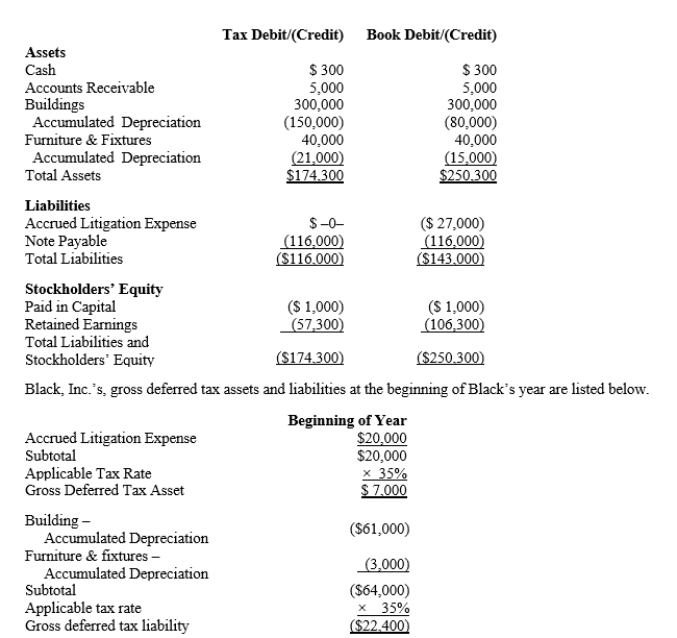

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  ?

?

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense.Determine Black's change in net deferred tax asset or net deferred tax

liability for the current year, and provide the journal entry to record this amount.

Definitions:

Dissociate

Ionization in which ions are dissolved in water and the cations and anions are surrounded by water molecules.

Charge

In physics, charge refers to a property of matter that causes it to experience a force when near other electrically charged matter; there are two types, positive and negative, which attract each other.

Solvent

Liquid that holds another substance in solution.

Anion

Ion carrying a negative charge.

Q20: Julius, a married taxpayer, makes gifts to

Q38: In 2007, Terry purchased land for $150,000.In

Q45: In the current year, Kelly had a

Q51: Two persons who live in the same

Q59: Harold bought land from Jewel for $150,000.Harold

Q60: An individual may deduct a loss on

Q80: Which, if any, of the following taxes

Q80: The major difficulty of the cash payback

Q89: Cost centre managers are evaluated on the

Q171: Which of the following may be deductible?<br>A)Bribes