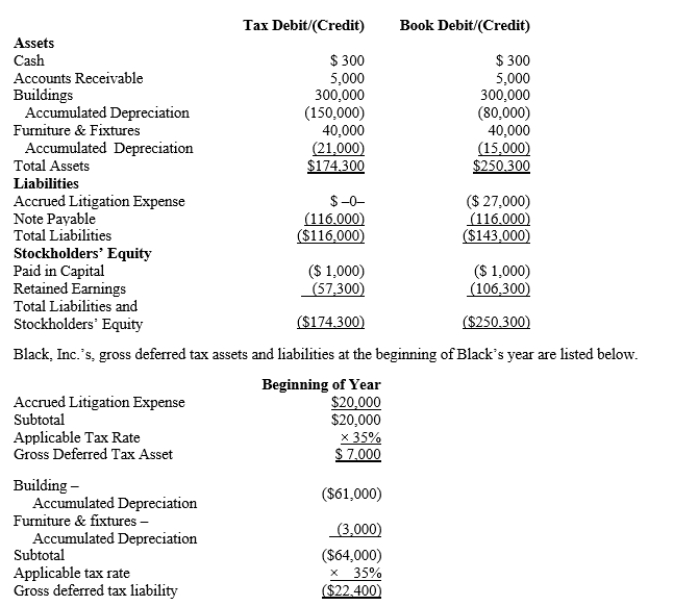

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  ?

?

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense.What is Black's total provision for income tax expense reported on its

GAAP financial statement and its book net income after tax?

Definitions:

Medical Technologist

A healthcare professional responsible for performing laboratory testing critical to the detection, diagnosis, and treatment of disease.

Respiratory Therapist

A healthcare professional specializing in the treatment and care of patients with breathing or other cardiopulmonary disorders.

Triage

To assess the urgency and types of conditions patients present as well as their immediate medical needs.

Q12: The major difference between the net present

Q15: Bark Company is considering buying a machine

Q24: On January 5, 2017, Tim purchased a

Q30: Which of the following statements is false?<br>A)By

Q71: Emily is in the 35% marginal tax

Q76: For purposes of determining gross income, which

Q77: A taxpayer must pay any tax deficiency

Q116: Wes's at-risk amount in a passive activity

Q139: Andrew, who operates a laundry business, incurred

Q171: Which of the following may be deductible?<br>A)Bribes